Updated at 3:15 p.m. with reaction to Senate's override of governor's budget veto.

Updated at 3:15 p.m. with reaction to Senate's override of governor's budget veto.

Harmon statement on Rauner’s reckless budget veto, Senate override

SPRINGFIELD – Senator Don Harmon, an Oak Park Democrat and president pro tempore of the Illinois Senate, released the following statement this afternoon:

“Two weeks ago, Gov. Bruce Rauner called the General Assembly into emergency special session to pass a responsible, balanced budget. Today, the General Assembly passed a responsible, balanced budget with support from Democratic and Republican lawmakers — and Gov. Rauner immediately vetoed it.

“His actions are unbelievable, hypocritical and irresponsible.

“This afternoon, the Senate overrode Gov. Rauner’s reckless veto of our responsible, balanced budget with bipartisan support. We put our duty to protect Illinois and its residents above petty, partisan politics.

“We invite Gov. Rauenr to come in from the campaign trail and do the same.”

-30-

Harmon: Senate passed a responsible, balanced budget package

SPRINGFIELD – Senator Don Harmon (D-Oak Park) released the following statement today regarding his vote on to send the governor a responsible budget package to prevent further financial upheaval in Illinois:

“Today’s bipartisan vote to send a responsible, balanced budget to Gov. Rauner was necessary. Just as every responsible business owner and head-of-household must do, Republican and Democratic lawmakers sat down with the books to find a way to make both sides of the ledger balance.

“Through a combination of deep spending cuts and modest revenue increases, we adopted a responsible, balanced budget that will halt the chaotic downward spiral from which it could take decades for Illinois to recover.

“We cut the state’s operational spending by about $5 billion.

“We cut state agency funding 5 percent across the board.

“We cut spending on pensions by $1.5 billion this year.

“We appropriated $380 million less than the governor’s proposed budget, and we devoted the budget surplus to paying unpaid bills.

“We closed corporate tax loopholes, recapturing almost $125 million in new tax revenue.

“We restored the income tax rate to 4.95 percent – the rate agreed to by Gov. Rauner and less than the rate in effect just three years ago.

“Two years of autopilot spending without a budget, coupled with various court-ordered payments, led to this inevitable vote: Illinois for the first time in history is no longer taking in enough revenue meet its monthly expenses. This isn’t a political accusation. It’s a mathematical reality.

“With this budget package, we’ll begin to address the state’s unpaid bill backlog, stabilize state universities, offer MAP grants to college students, ensure public schools open in the fall, fund human services, eliminate government programs that we can live without and stave off an embarrassing junk bond status for the state. It spends less than what the governor originally requested. It’s the right package for right now."

-30-

Budget fact sheet

The Senate today voted to send Gov. Rauner a budget package that could put an end to the two-year stalemate that has crippled Illinois’ finances and has bond rating agencies threatening to lower Illinois to an unprecedented “junk” credit rating this week.

- The House approved the same package of legislation on Saturday with support from both Republicans and Democrats.

- Gov. Rauner threatened to veto the package if it landed on his desk and by 2 p.m. had followed through on his threat.

- The Senate then voted to override the governor’s veto and sent the package to the House for an override vote.

- Wall Street was waiting to see what happens. Junk bond status means it would cost more for state and local governments to borrow money to pay for services and institutional investors would be forced to sell Illinois bonds at deep losses.

Overview of the budget

It’s a $36.1 billion balanced budget. It authorizes less spending than Gov. Rauner introduced in his $37.3 billion plan in February. It incorporates key ideas from plans put forth by both Democrats and Republicans.

Key components

$2.5 billion in spending cuts, including 5 percent across-the-board cuts to state agencies and departments, plus reductions to various state programs, grants and other expenditures

$1.5 billion in pension savings

Ensures K-12 schools will open in the fall and includes money for an evidence-based school funding model

Offers stability to state universities and community colleges, which have not been fully funded in two years and have undergone dramatic cuts and tuition hikes, driving students to pursue degrees out of state

Funds Monetary Award Program (MAP) grants for college students

Pays down about $8 billion of the state’s backlog of unpaid bills – which currently stands at $15 billion – through a combination of borrowing and fund sweeps

Changes the state income tax rates, closes tax loopholes and offers tax credits for low- and middle-income individuals and families. Total revenue: $36.4 billion

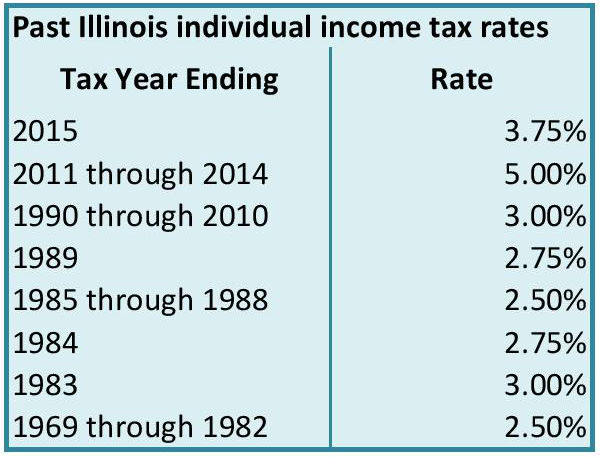

- Personal income tax rate will go to 4.95 percent from 3.75 percent. Generates $4.453 billion annually. This is a 1.2 percentage point increase, or a 32-percent increase in the tax rate.

- Corporate income tax rate will go to 7 percent from 5.25 percent. Generates $514 million annually.

- Both changes are permanent and both are retroactive to July 1, 2017.

There are no service taxes, no soda taxes, and no satellite or streaming taxes in this proposal.

Illinois would continue to be one of few states that do not tax retirement income.

Increases the Earned Income Tax Credit to 14 percent from 10 percent in 2017; increases to 18 percent in 2018.

Increases the cap on the Education Expense Credit to $750 per family from $500.

Creates a new tax credit of up to $250 for educators who use personal funds to purchase classroom supplies.

Means tests the Education Expense Credit, the Personal Exemption and the Property Tax Credit; they would only be available for those making less than $250,000 per year (single filers) or $500,000 per year (joint filers).

Reinstates the Research and Development Tax Credit

Closes three corporate tax loopholes worth a combined $125 million per year:

- Eliminates the domestic production deduction (decouples Illinois from federal tax law; Wisconsin and Indiana already did this.)

- Repeals the non-combination rule

- Eliminates loophole exempting areas outside of standard U.S. from taxation, “outer continental shelf”

Removes the sales tax discount for gas and extends the discount for majority-blended ethanols until December 2023, worth $100 million per year

Creates the Uniform State Tax Lien Registration Act, a Republican initiative. Allows the Illinois Department of Revenue to file notice of tax liens in the registry, bypassing the need to file them with county recorders. Worth $40 million per year.